What is that?

EORI number

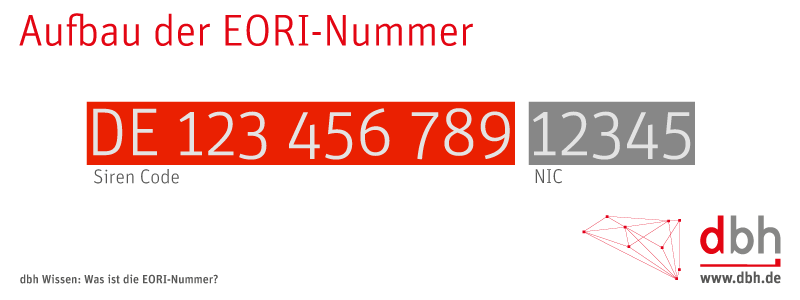

The EORI number replaces the German customs number. It is valid for the whole of the EU. The abbreviation EORI is called Economic Operators ‘ Registration-and Identification Number(german). Customs number EORI has been in force since 2009 and entered into force with Regulation (EC) No 312/2009.

Using the EORI number

For customs declarations and summary entry and exit declarations, the new European customs number shall be indicated. It is used to identify the parties involved. The number is unique and is issued by the relevant competent authorities. With regard to customs authorities, economic operators must legitimise Article 9 on the legal basis of the UCC (Union Customs Code) in conjunction with the UCC-DA (Delegated Regulation supplementing the UCC) Article 1(18).

Who are economic operators?

For the purposes of the European regulations, these are all persons, irrespective of their place of residence, whose business takes place in the EU or with EU countries and is accordingly covered by EU customs legislation. A distinction must be made between the two groups of EU citizens and non-EU citizens.

- EU citizens need the EORI number for their ordinary, regular business transactions and must apply for it in the EU Member State where they have registered their residence (UZK Article 9(1)).

- Third-country parties (citizens residing outside the EU) are registered by the Member State in which they intend to apply for a decision on their business dealings in the EU for the first time (UZK Art. 9 paragraph 2 i.V. UZK-DA Art. 5(6)).

The EORI number shall be dutifully indicated by economic operators in the exercise of transactions covered by EU customs legislation.

Private individuals are not considered to be economic operators if they make a maximum of nine customs declarations per year. In this case, they do not need an EORI number (UZK Art. 9 paragraph 3 i.V.m. UZK-DA Art. 6). This rule also applies if a service provider, usually a postal or express service provider, represents them directly in their business. An exception to this is made by exports subject to authorisation, which must be examined by the BAfA (Federal Office for Economic and Export Control). For this purpose, EORI number is also required for the business of private individuals.

EORI number: Customs declaration information

The German Zollanmeldungen Customs Customs Declaration leaflet indicates for whom the EORI number is to be indicated in the written or electronic customs declarations:

- Applicant or his representative

- Recipient

- Consignors/exporters or subcontractors

In the case of a summary entry or exit declaration, the customs number EORI for those parties shall be indicated:

Carrier at the entrance

- applicant (in ATLAS-EAS: SumA controller) or amending representative

- Receiver at the entrance

- Shipper at output

When registering for temporary custody, these parties require the EORI number:

- Frame

- Depositary

- Authorised

What is the purpose of the EORI customs number?

Customs number EORI is an identification or order indicator. Address data of the managing director can use it to view the authorisations granted to him by the customs administration of its network connections, taking effect the provisions of data protection. In addition, the EORI number for the approval procedures of the BAfA and the BLE (Federal Institute of Agriculture) must be indicated. In addition, executives thus prove to the tax office the payment of the import VAT, which is fixed paperless in the IT specialist procedure ATLAS.

Applying for an EORI number

The application is made formally to the master data management of the General Customs Directorate. The place of employment is Dresden. There are no fees. Forms to be used are either the IBA (Internet Participant Request) or the 0870 Form(Participating | Master Data | EORI number). Applicants sign the application legally and send it in writing, by fax or by e-mail (as PDF) together with the necessary documents to the GZD / DO Dresden / Master Data Management. When opening these forms, applicants will find a filling guide. This also contains information on the documents to be attached. This includes, for example, a trade declaration or a commercial register extract. The required fields must be filled in completely. If information such as the VAT identification number is not yet known, this must be marked. This information must be submitted immediately. As a rule, the EORI number is given without this information, and it must then be indicated in the case of subsequent submission. An application must be submitted in good time before the commencement of the relevant business activity, if it will be covered by European customs legislation.

Data transmission of EORI master data

The EORI master data corresponds to the ATLAS master data. They are transmitted to the EU customs authority (UZK-TDA Annex 9 Anl. E). There they can consult customs authorities from other European member states. The numbers can also be researched online. They are published on the Internet by the Master Data Administration of the General Customs Directorate, if the economic operator has given his consent to them. This has the advantage that business partners can determine the validity of the specified EORI number. Consent must be given in writing in accordance with the provisions of the GDPR.

EORI number for branch offices

If a company has non-legally legal business units as branch offices, they are registered as a branch under the EORI number of the head office. A request is also required for this. This corresponds to the recently entered into force of the branch concept for which ATLAS release 8.4.5 was created. If the non-legal entity units have already received their own EORI number prior to the real start of ATLAS release 8.4.5, they will be successively transferred to the head office. They must continue to use their own EORI number until the changeover date. These units do not require a new application for a branch number.

The EORI number in the IT procedure ATLAS

Since the ATLAS release 8.4 and the release of AES 2.1, the IT procedure ATLAS uses the EORI number for the identification of participants and participants. Another identifier for the national level is the so-called branch number, which has been used to assign non-legally legal branches to their respective head office (see previous point). This number will now be gradually replaced by the EORI number of the head office.

Do not confuse the EORI number

There are other business-relevant numbers that should not be confused with the EORI number. These include:

- VAT identification number

- Code number

- Tax

- Excise duty number

The code number is particularly interesting in this context because it is also relevant to customs. It has 11 bodies with an outline, such as 9504 0093 00 0, and encrypts the goods to be taxed, as well as the duty rate and authorisation requirements. The code number must also be specified in customs declarations. The other numbers mentioned are also relevant and well known for domestic transactions.

EORI number holders from abroad

If an economic operator from abroad already holds an EORI number and at the same time is an ATLAS participant and carries out business activities in Germany for which an EORI number is required, he does not apply for it again in Germany. EORI numbers are only assigned once. Instead, it sends its EORI number to the General Customs Directorate /Participant Management, which has its place of employment in Weiden.

Your contact to dbh

You have a question?

You have a question? Then write to us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

Do you use one of our products and need support? Our support team will be happy to advise you.